MEET OUR TEAM

Gabriel Horn Capital’s team has over 120 years of combined investment experience as limited partners, general partners, placement agents, and business development professionals. We have raised over $20 billion and invested more than $12 billion as limited partners.

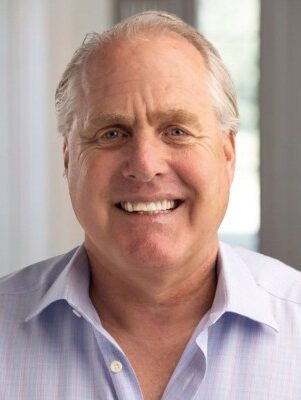

Brett Nelson

Co-Founder and Managing Partner

Brett A. Nelson is the Co-Founder and Managing Partner of Gabriel Horn Capital, LLC, an alternative investment placement firm committed to raising capital for funds and direct deals. With over 23 years of experience in alternative investments, he has managed global fundraising sales and invested more than $8 billion in various funds and co-investments.

Before this, Brett co-founded Bright Harbor Advisors, a global placement advisory firm offering fundraising, due diligence, and transaction negotiation services for private equity funds, including buyouts and venture capital. He also provided advisory services for secondary sales and fund restructuring.

He was previously a Principal and Head of Global Private Equity at Aon Hewitt, managing portfolio design and investment selection for global institutional clients. Additionally, he created and served as President & CEO of the firm’s Secondary Market Services.

Brett also held a Principal role at INVESCO Private Capital, where he focused on private equity partnerships and secondaries, and began his finance career with Price Waterhouse Coopers LLC in corporate finance.

He holds a B.S. in Electrical Engineering from Villanova University and an MBA from the LeBow College of Business at Drexel University, along with continuing education in Management from The University of Pennsylvania. Brett holds the Series 7, 63, 65 & 39 licenses.

Jonathan LaCrosse

Co-Founder and Managing Partner

Jonathan D. LaCrosse is the Co-Founder of Gabriel Horn Capital, LLC, a firm focused on raising capital for funds and deals. With over 20 years of alternative investment experience, he has helped raise more than $4.5 billion and invested over $4 billion in various funds and co-investments. He has served on 35 Board Director and Advisory Boards.

Before this, he co-founded Trusted Insight, Inc., the largest online marketplace for alternative investments, connecting over 400 institutional investors from 90 countries. He secured Series A financing during his tenure. Mr. LaCrosse was also a Founding Partner at Centinela Capital Partners, LLC, managing $1 billion in assets and approving over $825 million in 41 deals.

From 1994-2006, he was an Investment Officer at the Robert Wood Johnson Foundation, overseeing private equity and credit strategies. He led due diligence and managed over $3.1 billion in 121 funds, serving on 25 advisory boards across various fund types.

Mr. LaCrosse holds an M.B.A. from Rider University and a B.S. from Rowan University, along with Series 7, 63, and 79 securities licenses.

Michael Wren

Director

Mike Wren is a Director at Gabriel Horn Capital LLC, where he is responsible for fundraising efforts for Gabriel Horn Capital’s alternative investment funds and direct deals. He has over 15 years’ experience in the investment industry including 10+ years in an outsourced placement capacity with a wide range of investment strategies.

Previously, Mike was a Managing Director with Hamersley Partners LLC, a boutique sales and marketing firm working with traditional and alternative investment management firms across the United States and Canada. While at Hamersley Partners, he was part of team that raised north of $4.5 billion in assets from institutional investors around the globe. Prior to joining Hamersley Partners, he worked with Parker Point Capital in a similar capacity engaging in institutional marketing for investment managers. Concurrently while working with Parker Point, he also managed the team of research analysts with Brighton House Associates, an investment marketing research firm. Prior to that, he held positions at both John Hancock Distributors and Evergreen Investments working in retail sales and client service respectively.

Mr. Wren is a graduate of Salve Regina University with a BA in History. He holds the Series 6, 7, and 63 securities licenses.

Catherine Crabtree

Operations

Catherine Crabtree supports operations and executive administration at Gabriel Horn Capital LLC, where she is responsible for the ongoing optimization of deal operations, systems integration, marketing communications, and reporting.

She has over 20 years’ experience in commercial strategy, account management, revenue operations and executive search, for global organizations in SaaS, management consulting and business process outsourcing supporting technology, energy, financial services, healthcare and manufacturing industries.

Previously, Catherine was Commercial Strategy Officer with TeKnowledge Inc, an IT managed services provider to governments and private enterprises, specializing in cybersecurity and technical skilling. Prior to TeKnowledge, she was Vice President, Account Management for Concentrix Corporation, a $10B technology consulting and business process outsourcing firm, where she managed an account team responsible for revenue in excess of $100M across multiple vertical markets.

Juan Lopez

Vice President

Juan Lopez is a Vice President at Gabriel Horn Capital LLC (“GHC”). Prior to joining Gabriel Horn Capital, Juan was leading investor relations and impact investment initiatives as a Partner at Health Innovation Capital, a performance-based impact venture capital firm. Prior to Health Innovation Capital, Juan was a Client Portfolio Manager for Madera Technology Partners; a boutique alternative investment management firm specializing the use of data science to invest in publicly listed securities as well as private capital transactions; with a focus on new and emerging disruptive technologies. Prior to Madera, Juan has served as the Investment Officer for the Municipal Annuities and Benefit Fund of Chicago (MEABF), where he led the plan’s $5 billion investment portfolio across asset classes; including private equity. Prior to MEABF, Juan was an Investment Officer for the Teachers’ Retirement System of the State of Illinois (IL TRS), where he served on the plan’s Private Equity Oversight Committee which deployed approximately $1.2 billion in annual private equity commitments. Juan also led the plan’s $1 billion Emerging Managers Program. Mr. Lopez has an BS in finance from the University of Illinois at Urbana-Champaign and an MBA from the University of Chicago, where he was a Robert Toigo Fellow. Juan is a Chartered Alternative Investment Analyst (CAIA) and is pursuing the CFA’s Certificate in ESG investing. Juan has his FINRA Series 7, 63, 65 and 24 licenses.

Bob Hennessey

Managing Director

Bob Hennessey develops and maintains business across distribution channels, including Institutions, Registered Investment Advisors, Family Offices, and HNW advisors. He was most recently a Managing Director with Samara Alpha Management, a leading digital asset manager, where he was responsible for business development and investor relations. Bob has more than 25 years of experience raising capital at leading firms, including Arca, Delaware, FAMCO, Insight Capital, and Axxcess Capital. He earned an MBA from California State University and a Bachelor of Science in Finance from Florida State University. Bob received his CIMA accreditation in 2003.

Mike Kinney

Advisor

Mike Kinney has focused his career in institutional sales for over 25 years, serving as Vice President/Regional Director for financial institutions such as Nuveen, Van Kampen, and American Realty Capital. He has successfully raised more than $2B from both the public and private sectors, cultivating deep relationships with Institutions, Family Offices, Registered investment Advisors (RIA’s) and Ultra High net Worth Individuals.

Mike brings the diversified skill sets of raising capital, consulting to mergers/acquisitions, Capital Markets and product distribution. Product Knowledge & Experience includes mutual funds, separately managed accounts, non-traded REIT’s, Reg D’s & private placements, Hedge Funds, and Master Limited Partnerships.

After many years in corporate finance, Mike went on his own and founded Capital Group LLC. CG focuses on designing business development & capital markets strategies for under the radar asset managers, real estate private placements, non-profit organizations, start-up ventures and social impact investments here in the states and overseas.

Ryan J. Hurst

Advisor

Ryan J. Hurst is an Advisor at Gabriel Horn Capital LLC, LLC. He is currently the Treasurer at Motiv Power Systems, Inc where he joined in 2013 and has since led all of the institutional capital raises, enabling the company to pioneer the software and power electronics market it now leads for medium duty, commercial electric vehicles.

He is also Co-Founder & Partner at Hurst Investments, a private family office established in 2018.

Previously, Ryan was Co-Founder and Development Partner of Blackhorn Ventures Capital Management from 2015-2017 and Founder & CEO of Liber, LLC, a business development & investment company from 1999-2015. He has decades of experience managing investments ranging from public markets to early stage ventures. Through his active investments, Ryan has led all aspects of business and corporate development with versatility across a wide range of industries from finance to engineering-based companies.

In 2019, Ryan was appointed by Colorado Governor Jared Polis to the Regional Air Quality Council’s Board of Directors, citing his long-term passion for clean air and vehicle electrification.

Ryan has a BBA in Finance from SMU and holds Series 82 and 63 licenses. He lives in Denver and has climbed all of the 55 official 14,000 foot peaks in Colorado.

Gabriel Horn Capital, LLC offers securities through Invicta Capital, LLC. Member: FINRA/SIPC. Gabriel Horn Capital, LLC is not affiliated with Invicta Capital, LLC. Broker Check | Form CRS